FROM THE FOUNDATION PRESIDENT

Happy New Year! Welcome to the second issue of Forensic and Business Valuation News and Views.

Happy New Year! Welcome to the second issue of Forensic and Business Valuation News and Views.

Let’s start out the year with a hypothetical: You represent the spouse of someone who invested, with your client’s prior knowledge and consent, $1,000,000 of community or marital property (depending the state in which your practice is located) in a private equity investment partnership. The joint funds were invested one year ago, and by the terms of the partnership the payout to investors is to be completed 10 years from the inception of the fund (nine years from now). There is a “guaranteed” return of 8%, to be paid at the end of year 8. But if the fund performs as expected, there will be a return of far more than that by the end of year 10. There is no dispute that the investment is community or marital property. The larger increment – and the reason that people invest in private equity funds such as this one – is the so-called “carried interest.”

Your client can, of course, “stay in” and split the return – whatever it is – at the end of 10 years. But let’s suppose that your client does not have the same tolerance for risk as the spouse who made the investment (see, for example, In re Marriage of Burkle (Burkle II) (2006) 139 Cal.App.4th 712) or just does not want to wait nine years to cash out. So now you’re thinking about awarding the investment to the “investor” spouse at its current value, as would be the case with a piece of real estate or a business that is awarded to one spouse rather than left in co-ownership.

But wait! This isn’t a house or a business. It’s not even a pension that can be valued and awarded to one spouse (even though that happens a lot less often now than it did 50 years ago).

The present value of the 8% return is easy for your friendly forensic to determine, but what about the carried interest? That’s the big number. So before you put your client into a settlement whereby he or she receives a lump sum for half the carried interest, the amount of which has not yet been determined, you better make sure that it’s valued properly. You also need to be sure that you know enough about how the payout is determined to be able to explain it clearly to your client.

That is the subject of this issue’s article by Forensic and Business Valuation Division Member Vlad Korobov, “Carried Interest: What It Represents and How to Value It.” Vlad not only explains how you (or, let’s face it, your expert) should “crunch the numbers,” he gives us an example of how it’s done.

Here’s why you need to get it right: After entering into a postnuptial agreement to have her husband cash her out of a number of high-dollar, high-risk investments, upon divorce the wife in Burkle, supra, saw how much he had made from them and tried to get the court’s permission to change her mind. The California Court of Appeal held that she could not get a “do-over.”

We know you’ll enjoy Vlad’s article and hope you’ll find it useful.

With warm regards,

Lawrence A. Moskowitz

AAML Foundation President

CARRIED INTEREST: WHAT IT REPRESENTS AND HOW (BEST) TO VALUE IT

Vladimir V. Korobov, CPA, ABV, ASA

What is Carried Interest?

What is Carried Interest?

As a type of incentive compensation, carried interest and similar profit-sharing arrangements [1] have been around for a long time. The notion of carried interest dates back to medieval times and relates to the share of profits that ship captains received on the cargo they carried.

Carried interest has been a staple of the private equity and venture capital industries in the United States for many years.

How It Works

Carried interest typically represents a share of proceeds from a sale of a portfolio investment, which is determined using the proceeds allocation formula (often referred to as a “waterfall”) specified in an investment fund’s formational document, such as a partnership agreement. Following is an example of a typical waterfall used in private equity and venture capital funds:

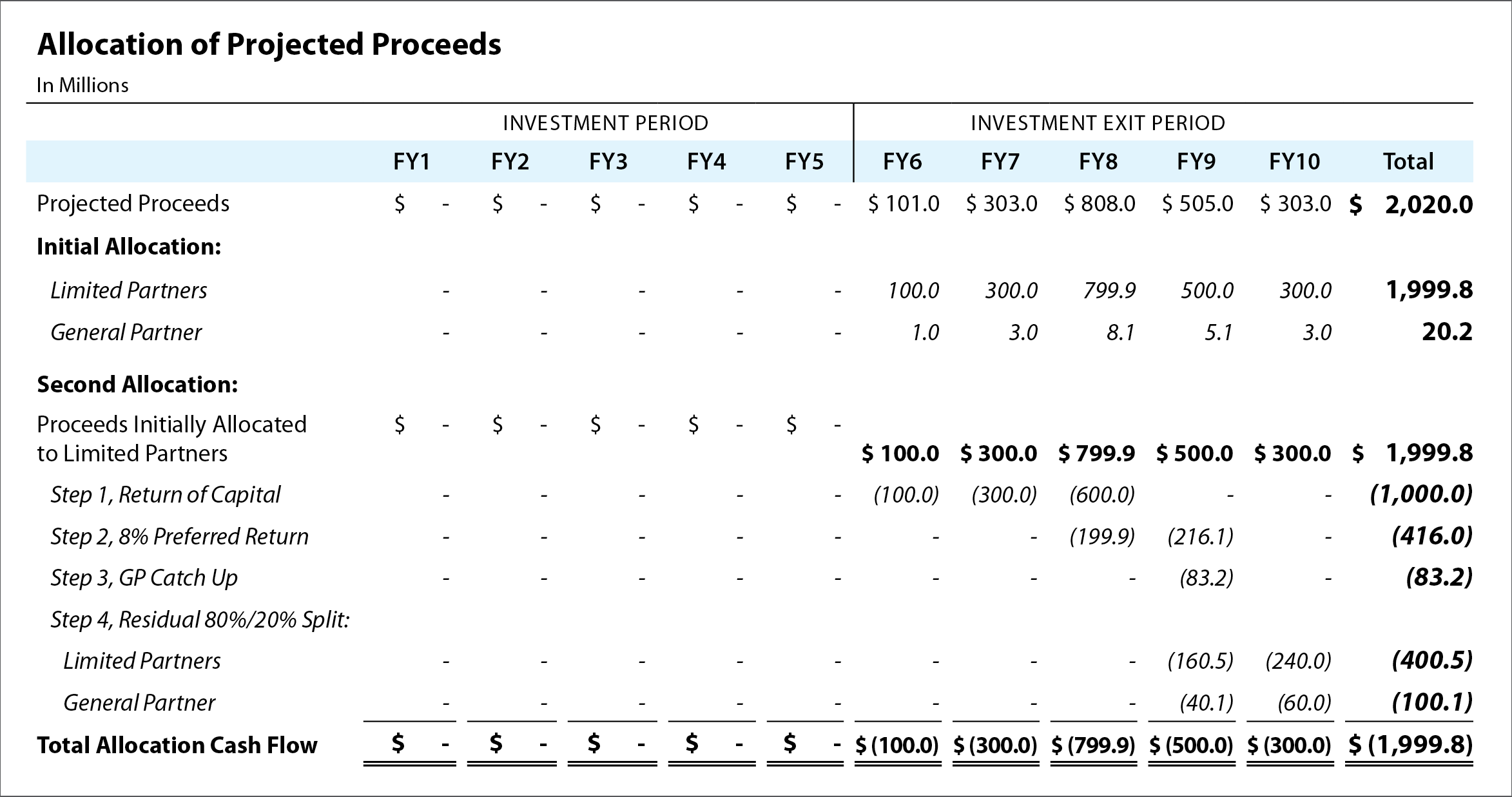

Initial Allocation: Proceeds from the sale of a portfolio investment are initially allocated pro rata between a general partner (“GP”) and the limited partners (“LPs”) based on the partners’ respective capital contribution percentages.

Second Allocation: Proceeds initially allocated to the LPs are then re-allocated between the LPs and a GP as follows:

- Step 1, Return of Capital – First, 100% to LPs until LPs have recouped their capital contributions used to fund portfolio investments, fees and expenses;

- Step 2, Preferred Return – Then, 100% to LPs until LPs have earned an 8% return (compounded annually) on their capital contributions;

- Step 3, GP Catch Up – Then, 100% to a GP until the GP has received 20% of the amount distributed to the LPs in Step 2; and

- Step 4, Residual Split – Thereafter, 80% to the LPs and 20% to the GP.

The GP’s right to receive distributions under Steps 3 and 4 above represents the GP’s carried interest in the investment fund.

Why Value Carried Interest?

If an investment fund is successful, carried interest can generate significant distributions to a holder over the fund’s life. It is not a surprise then that a question of valuation of carried interest often becomes a hot issue in a divorce.

When “Value” May Not Be Value

Readers may ask: “If a GP of the fund determines the values of the fund’s investments as of a given date and calculates the amount of a carried interest distribution, if any, that the GP would receive upon a hypothetical liquidation of the fund’s investments at those values, wouldn’t the amount of the distribution represent the value of the GP’ carried interest on that date?” The answer, in most cases, is generally no for at least three reasons.

First, a hypothetical liquidation scenario does not capture any potential value of a fund’s “dry powder,” i.e. remaining capital commitments. This potential value is highest at the earlier stages of a fund’s life. Second, the hypothetical liquidation scenario does not reflect the time value of money. Third, carried interest effectively represents a call option on a share of the fund’s profits over the investors’ preferred return. Thus, the hypothetical liquidation scenario does not consider a potential for future appreciation of the value of the investments, i.e., the time value of the call option, which can be significant in the early stages of the fund’s term.

Carried Interest Valuation

If the hypothetical liquidation scenario is not the right answer to the question of value of a carried interest in most cases, then what is? The right answer is the present value of the expected cash flow, or the carried interest distributions expected to be received over the life of the fund. The present value can be determined utilizing either an option-pricing framework, or a discounted cash flow method. In this essay, we will illustrate a valuation analysis using the discounted cash flow method.

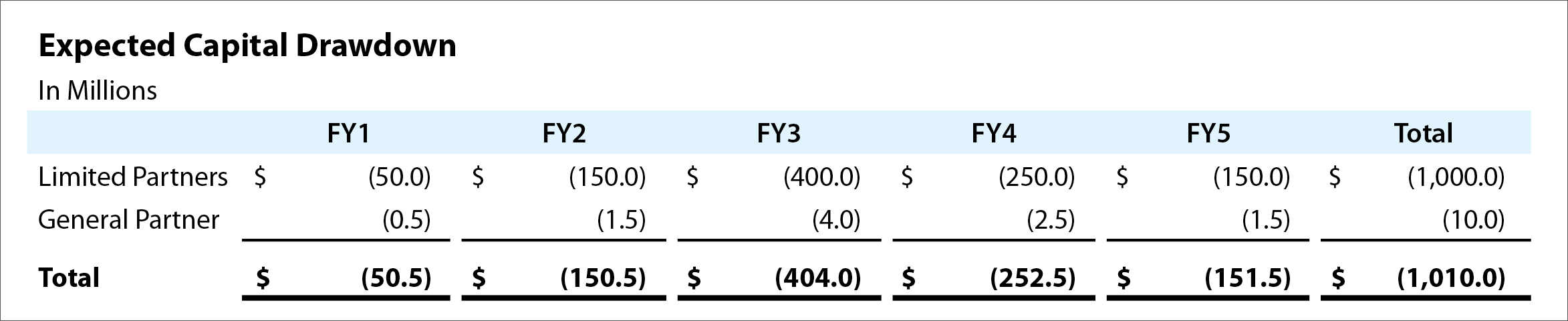

Let us consider the following scenario. A private equity firm has just raised a new fund with $1 billion of investor commitments. The GP of the fund has committed 1.0% of the investor commitments, or $10.0 million. The fund has a term of 10 years, which is divided into the investment period (the first five years) and the investment exit period (the last five years). Based on experience with earlier funds, the GP expects an average holding period for investments to be 5 years, and believes that the fund could realize value of 2 times invested capital. The GP estimates the following capital drawdown schedule during the investment period:[2

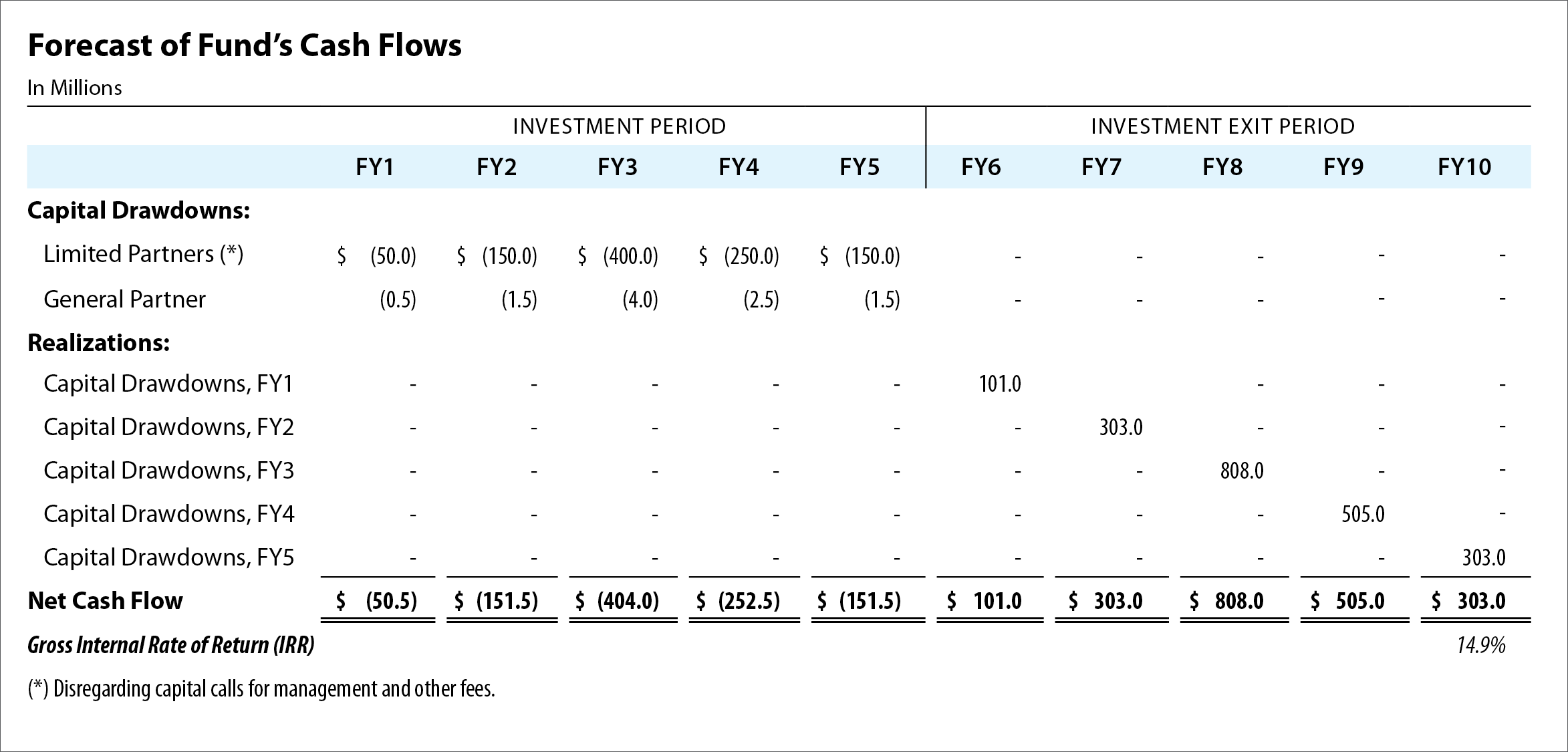

Based on the estimated capital drawdown schedule, the expected holding period, and the targeted performance of 2 times invested capital, we can develop a forecast of cash flow over the fund’s term:

We can then allocate the projected proceeds between the general partner and limited partners using the typical waterfall presented earlier:

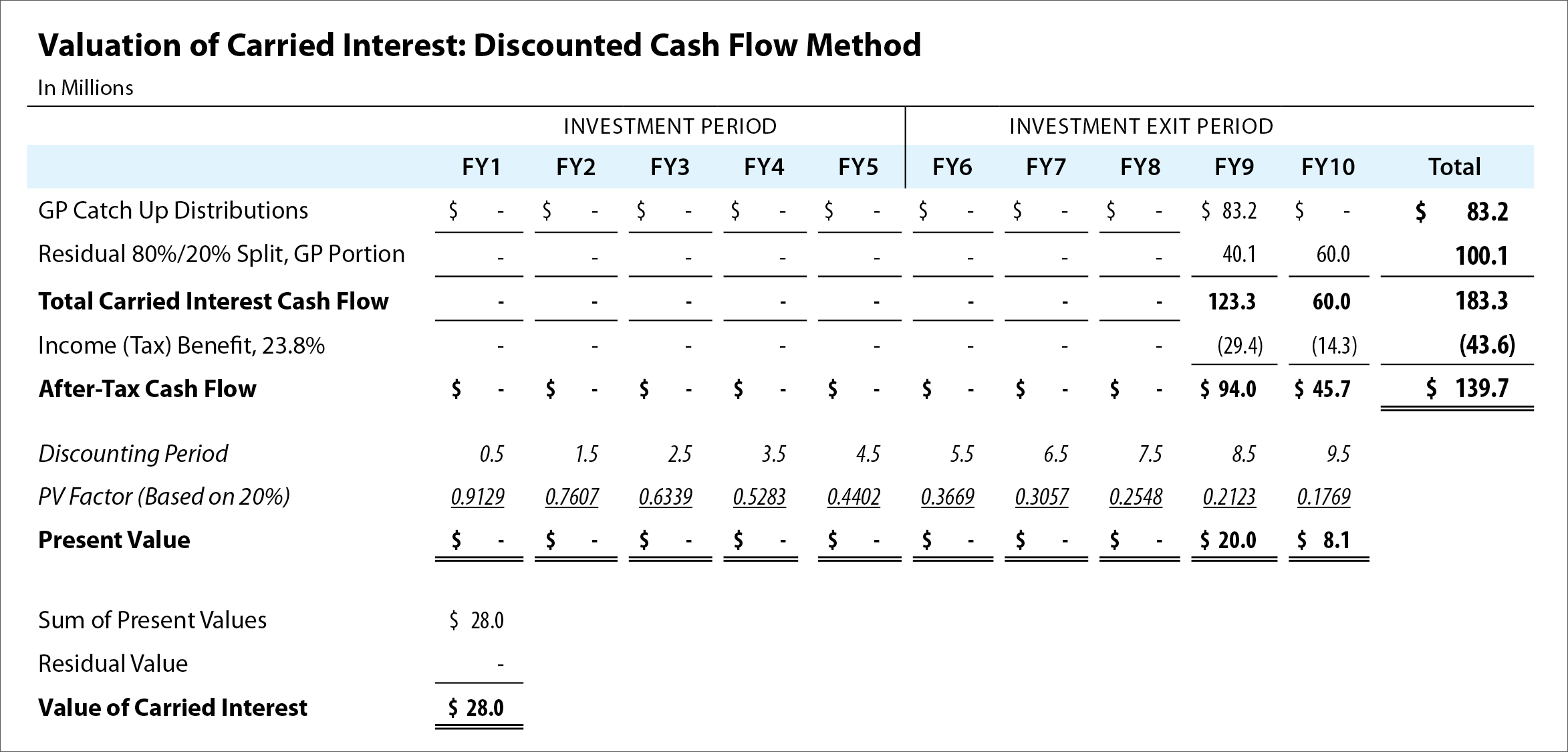

Now that we have identified the future carried interest distributions – specifically, the distributions to the GP in Steps 3 and 4 — we can determine the value of the carried interest as the present value of the projected carried interest distributions. Assuming an income tax rate of 23.8% and a discount rate of 20%, the value of the carried interest would be $28.0 million, as calculated in the following table:

[1] An example of a profit sharing arrangement similar to a carried interest is a developer’s promote in a real estate development project.

[2] For purposes of this illustration, we will disregard management and other fees that limited partners may be subject to.

[3] The income tax rate consists of the federal long-term capital gain tax rate of 20% and the net investment income tax of 3.8%. For illustration purposes, we assumed that the carried interest distributions would not be subject to the state income taxes.

VLADIMIR V. KOROBOV, CPA, ABV, ASA, is a partner at Marcum LLP in the Valuation and Litigation Support Services group. He has more than 20 years of experience providing business valuation, litigation support, and advisory services with a focus on alternative and traditional asset management, and financial institutions.

The Officers and Directors of the American Academy of Matrimonial Lawyers Foundation wish to express our sincere gratitude to the following individuals listed below: the 2020 donors, sponsors, Forensic and Business Valuation Division members, and all other supporters of the work of the Foundation.

The year 2020 will be remembered for the extreme challenges presented to the social order. While the needs of children, victims of domestic violence and individuals going through divorce dramatically increased this year, sources to address those needs contracted. The pandemic has underscored the increased need for medical care, mental health treatment, and housing and technology for parents and children at a time when the safety net of charities which normally operate near the edge was hit hard. Candid, an advisor to charitable organizations, reported that while approximately 12,000 U.S. charities cease operations each year, they expected as many as 120,000 charities to cease operating during this pandemic year, which could result in a crisis of epic proportions.

The urgency of the moment demands that people who can afford to donate give as much as they can. Our donors, sponsors, F&BV Division members, and other supporters stepped up in 2020 and deserve our recognition and gratitude. Will you look back five or ten years from now and wish you had done less?

2020 Billable Hour Donors

We thank those who made their annual donation to the Foundation in an amount equal to one billable hour of their time. The billable hour campaign funds our annual grants.

Alabama

Anne Lamkin Durward

G. John Durward, Jr.

Kathryn C. Gentle

Arizona

William D. Bishop

Helen R. Davis

Kiilu Davis

Aris J. Gallios

California

Hal D. Bartholomew

Robert A. Benavente

Michele M. Bissada

Robert E. Blevans

Andrew J. Botros

Robert C. Brandt

Sharon A. Bryan

Renee R. Chernus

Bruce A. Clemens

Joseph P. Crawford

Gordon D. Cruse

Judi A. Curtin

Patrick DeCarolis, Jr.

Hildy L. Fentin

Scott H. Finkbeiner

Shane R. Ford

Ira M. Friedman

Saul M. Gelbart

Donna T. Gibbs

Larry A. Ginsbeg

William J. Glucksman

Ronald S. Granberg

Abbas Hadjian

Stephen D. Hamilton

James William Hargreaves

Gregory W. Herring

Neal Raymond Hersh

Evan C. Itzkowitz

Daniel J. Jaffe

Scott M. Klopert

Michael J. Kretzmer

Alexandra Leichter

Avi Levy

Thomas Trent Lewis

Victoria K. Lewis

Arthur C. Lin

Sharon F. Mah

Deborah J. Marx

Sandra L. Mayberry

John P. McCall

Yasmine Suzanne Mehmet

Shannon B. Miles

Steven A. Mindel

Lawrence A. Moskowitz

Alexandra Mussallem

Lorie S. Nachlis

Annette Hall Neville

Ashley M. Rodet

Gretchen B. Rubel

Geniveve J. Ruskus

William S. Ryden

Lee W. Salisbury

John R. Schilling

Glen Howard Schwartz

Brian G. Seastrom

Philip G. Seastrom

Lonnie K. Seide

Thomas L. Simpson

Sheila Prell Sonenshine

Harold Jay Stanton

Eleanor A. Stegmeier

Jeff M. Sturman

Nancy A. Taylor

Edward J. Thomas

Suzie S. Thorn

Rebecca A. Tran

Thomas W. Tuttle

Stephen James Wagner

Gretchen M. Wallacker

Marshall W. Waller

Peter W. Walzer

Thomas W. Wolfrum

Marshall S. Zolla

Colorado

Carl O. Graham

Denise K. Mills

Connecticut

David W. Griffin

Lee Marlow

Edward Nusbaum

Sarah S. Oldham

Thomas P. Parrino

Gerald A. Roisman

Arnold H. Rutkin

Frederic J. Siegel

Paul T. Tusch

Christine M. Whitehead

District of Columbia

Sanford K. Ain

Marina S. Barannik

Barbara A. Burr

Gregory R. Nugent

Paul R. Smollar

Natalia C. Wilson

Florida

Kristin Adamson

Jesse J. Bennett, Jr.

Caroline Black Sikorske

Alexander Caballero

Jorge M. Cestero

J.J. Dahl

Lawrence C. Datz

Rueben A. Doupe

Dori Foster-Morales

Melinda P. Gamot

Carmen R. Gillett

Peter L. Gladstone

Caryn M. Green

N. Diane Holmes

Allyson Hughes

Joseph D. Hunt

Brian M. Karpf

Mitchell K. Karpf

Ky M. Koch

Natalie S. Lemos

Ashley McCorvey Myers

Shannon L. Novey

Yueh-Mei Kim Nutter

Jonathan S. Root

Elisha D. Roy

Thomas J. Sasser

Philip J. Schipani

John F. Schutz

Mark A. Sessums

Robert W. Sidweber

Laura Davis Smith

Bonnie S. Sockel-Stone

Karen B. Weintraub

Richard D. West

Ralph T. White

Georgia

Jonathan R. Levine

Elizabeth Green Lindsey

Tina Shadix Roddenbery

Alvah O. Smith

Bruce R. Steinfeld

Illinois

Brian J. Blitz

Stephen R. Botti

Janet E. Boyle

Jeffrey W. Brend

William G. Clark, Jr.

Kimberly A. Cook

Joy M. Feinberg

Howard W. Feldman

Gunnar J. Gitlin

Cecilia Hynes Griffin

Meighan A. Harmon

Burton S. Hochberg

Adam C. Kibort

Steven H. Klein

Michael F. Koenigsberger

Karen L. Levine

David H. Levy

Carlton R. Marcyan

Lee A. Marinaccio

Nanette A. McCarthy

Alyssa Mogul

Lisa M. Nyuli

Riaford D. Palmer

Saundra L. Rice

Allison Audra Stein

Anita M. Ventrelli

Steven Gregg Wittenberg

Errol Zavett

Richard Wayne Zuckerman

Iowa

Jacob R. Koller

Kansas

T. Lynn Ward

Kentucky

Jeffery P. Alford

Bonnie M. Brown

Laurel S. Doheny

Ross T. Ewing

Maine

Catherine C. Miller

Elizabeth J. Scheffee

Maryland

David S. Coaxum

Susan Carol Elgin

Maureen Glackin

Michael G. Hendler

Cheryl Lynn Hepfer

Heather Quinn Hostetter

Richard B. Jacobs

Stephen Philip Krohn

Rhian McGrath

Christopher W. Nicholson

Linda Sorg Ostovitz

Linda J. Ravdin

Paul J. Reinstein

Thomas C. Ries

Mary R. Sanders

Keith N. Schiszik

Howard B. Soypher

Laurie M. Wasserman

Deborah L. Webb

Vincent M. Wills

Massachusetts

Jennifer B. Koiles Pratt

Jennifer C. Roman

Ronald A. Witmer

Michigan

Mark A. Bank

Elizabeth K. Bransdorfer

Lori Ann Buiteweg

Laura E. Eisenberg

B. Andrew Rifkin

Richard A. Roane

Lynn Capp Sirich

Minnesota

Brian L. Sobol

Lisa T. Spencer

Missouri

Gail Berkowitz

James T. Cook

Cary J. Mogerman

John S. Pratt

Anita I. Rodarte

Nebraska

Virginia A. Albers

John S. Slowiaczek

Nevada

Jennifer V. Abrams

Robert Cerceo

Marshal S. Willick

New Jersey

Cary B. Cheifetz

Amy Sara Cores

Carolyn N. Daly

Richard F. Iglar

Jeralyn L. Lawrence

Madeline Marzano-Lesnevich

Christopher Rade Musulin

Francesca M. O’Cathain

Gary N. Skoloff

Edward S. Snyder

Eric S. Solotoff

New Mexico

Twila B. Larkin

New York

Alton L. Abramowitz

Susan L. Bender

Mitchell Y. Cohen

Donna M. Genovese

Sylvia Goldschmidt

Leigh Baseheart Kahn

Nancy D. Kellman

Allan D. Mantel

John Anthony Pappalardo

Lee Rosenberg

North Carolina

Shelby Duffy Benton

Joslin Davis

Barbara R. Morgenstern

Tate K. Sterrett

Robin J. Stinson

Elise M. Whitley

Ohio

Gerald Jay Babbitt

Phyllis G. Bossin

Douglas M. Brill

Andrea L. Cozza

Scott N. Friedman

S. Scott Haynes

Corinne Hoover Six

Wijdan Jreisat

Jacqueline L. Kemp

James R. Kirkland

Jacob A.H. Kronenberg

Randal A. Lowry

Pamela J. MacAdams

Denise M. Mirman

Gary M. Rosen

Mark Edward Stone

Timothy A. Tepe

Craig P. Treneff

Lon R. Vinion

Amy J. Weis

Oklahoma

David W. Echols

Richard A. Wagner, II

Pennsylvania

Julia A. Auerbach

Robb D. Bunde

Brian J. Cali

Mary Cushing Doherty

Sandra Edwards Gray

David N. Hofstein

Candice L. Komar

David L. Ladov

James E. Mahood

Charles J. Meyer

Colleen M. Neary

James H. Richardson, Jr.

Reid B. Roberts

Lori Kessler Shemtob

Randi J. Silverman

Julia Swain

Brian C. Vertz

Robert I. Whitelaw

Rhode Island

Deborah M. Tate

South Carolina

Catherine S. Hendrix

John O. McDougall

James T. McLaren

Sandra R. Parise

Joseph M. Ramseur, Jr.

David C. Shea

J. Benjamin Stevens

Robert E. Stevens

J. Michael Taylor

Rebecca West

Richard G. Whiting

South Dakota

Linda Lee M. Viken

Tennessee

Amy J. Amundsen

Marlene M. Moses

Texas

Kristen A. Algert

Thomas L. Ausley

Maisie A. Barringer

Jonathan Bates

Martha Flowers Bourne

JoAl Cannon Sheridan

Patricia N. Carter

Katie Custer

Angela Pence England

Sherri Evans

Donn C. Fullenweider

Charles E. Hardy

Robert S. Hoffman

Lynn Kamin

Katherine S. Kinser

Clint F. Lawson

Keith D. Maples

Larry L. Martin

Tammy Simien Moon

Adam J. Morris

James N. Mueller

Kathryn J. Murphy

Eric Robertson

Barbara K. Runge

Angela A. Stout

John E. Van Ness

Jimmy Vaught

Michael P. Von Blon

Lauren E. Waddell

Ellen A. Yarrell

Sam (Trey) M. Yates, III

Alvin L. Zimmerman

Harold C. Zuflacht

Utah

Amy H. Kennedy

Virginia

Jennifer A. Bradley

Peter W. Buchbauer

Cassandra M. Chin

Julie M. Cillo

Richard E. Garriott, Jr.

Alanna C.E. Williams

Carl J. Witmer, II

Washington

Linda Kelley Ebberson

Wisconsin

Rebecca K. Millenbach

New Lifetime Members

In addition to a billable hour donation, a Lifetime Member shows their commitment to the Foundation by making a one-time donation of $2500 or a $3000 donation paid over 6 years which makes you a Foundation member.

Gregory S. Beane

Guy M. Hild

Avi Levy

David N. Marple

Joani C. Moberg

Laura W. Morgan

Mountain States Chapter

Ronique Bastine Robinson

Diane M. St. Yves

Natalie L. Webb

2020 Event Sponsors

Our Event Sponsors underwrite the costs of our fundraising events so that donations can be utilized as intended—to help children and families going through divorce and separation.

Aronson Mayefsky & Sloan LLP

CBIZ MHM, LLC

Financial Research Associates

Northern Trust

STOUT

Forensic and Business Valuation Division

The Foundation established the Forensic & Business Valuation Division to permit forensic experts and business valuation professionals of unquestioned integrity and professionalism to partner with the Foundation in facilitating Foundation goals.

Les Barenbaum, Financial Research Associates

Marc Bello, Edelstein & Company LLP

David Blumenthal, Gursey | Schneider, LLP

Stephen Bravo, Stephen J. Bravo & Company

Justin Cherfoli, STOUT

Cindy Collier, Cindy Collier & Associates

Stacy Collins, Financial Research Associates

Bill Dameworth, Forensic Strategic Solutions

Marie Ebersbacher, CBIZ MHM, LLC

Joe Estabrook, STOUT

Nancy Fannon, Marcum LLP

Jay Fishman, Financial Research Associates

Jim Godbout, CliftonLarsonAllen LLP

George Hawkins, Banister Financial, Inc.

Jim Hitchner, Valuation Products and Services

Howard Kaminsky, CBIZ MHM, LLC

Tracy Katz, Gursey | Schneider, LLP

Sandy Klevan, Financial Research Associates

Vlad Korobov, Marcum LLP

Mark Luttrell, Luttrell Wegis LLP

Harold Martin, Jr., Keiter

Chris Mercer, Mercer Capital

Bill Morrison, Withum, Smith + Brown, PC

Anthony Phillips, CBIZ MHM, LLC

Ken Pia, Jr., Marcum LLP

David Politziner, EisnerAmper, LLP

Brian Potter, STOUT

Shannon Pratt, Shannon Pratt Valuations

Michael Raymond, BST & Co. CPAs, LLP

Ron Seigneur, Seigneur Gustafson, LLP

Briggs Stahl, Baker Tilly Virchow Krause, LLP

Catherine Stoddard, Dixon Hughes Goodman LLP

Robert Stone, Kaufman, Rossin & Co.

What is Carried Interest?

What is Carried Interest?